Plutus, a UK-based fintech company, has steadily gained ground in the financial rewards sector. The company, which offers a crypto rewards card, combines traditional finance features with its crypto rewards token, PLU. Although not a bank, it provides “bank-like” services and allows users full control over their rewards. This approach has resonated with customers in the UK and the European Economic Area (EEA), helping the company stand out in a market often dominated by larger financial institutions.

How Plutus Found Its Footing in a Crowded Market

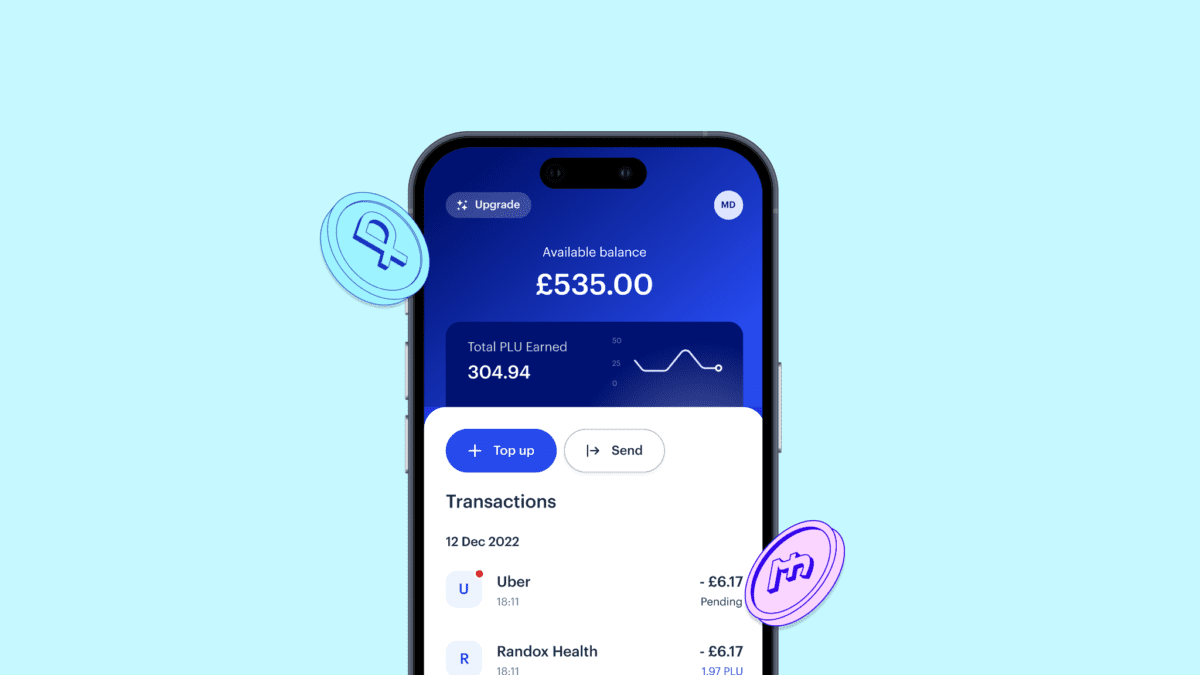

Since its launch in 2016, Plutus has offered users a way to earn cryptocurrency through everyday purchases. By allowing customers to spend fiat currencies like GBP or EUR and receive a portion of their spending back in Pluton (PLU) — the world’s first crypto rewards token (2016) — it has made cryptocurrency more accessible to the general public without the need for speculative trading.

Competing in a market with established programs from companies like American Express presented challenges. Plutus set itself apart by introducing a non-custodial rewards model, where users maintain full control and ownership of their rewards in their personal wallets. By 2024, it had grown to over 125,000 customers across the UK and EEA, reflecting its success in building a dedicated user base.

Plutus’ Role in the Growing Fintech Industry

The fintech industry has grown rapidly over the past decade, driven by advancements in digital banking, blockchain technology, and decentralized finance (DeFi). In the UK, the sector is expected to grow at a compound annual growth rate (CAGR) of 12-15% between 2024 and 2025.

Plutus plays an active role in this growth. Its main product, the Plutus Debit Card, offers competitive reward rates of up to 9% and integrates traditional banking features with cryptocurrency management through a user-friendly finance app. This app allows users to track spending and manage rewards.

Plutus distinguishes itself by focusing on user control and flexibility. Unlike many companies that require users to store rewards in company-controlled wallets, it ensures that users retain full ownership of their rewards. This approach appeals to those who value financial independence and prefer managing their assets directly.

Founder Danial Daychopan states, “Plutus gives users control over their finances. The non-custodial model is central to this goal, ensuring customers have the flexibility and ownership they deserve.”

Expanding to New Markets: Opportunities and Challenges

Plutus plans to enter the US market. This expansion presents an opportunity to reach a larger customer base but also brings challenges, such as strong competition and a complex regulatory environment.

The company will leverage its strengths, such as its user-focused products and commitment to customer autonomy, to succeed in the US market. As it grows, the company aims to increase brand awareness and establish itself further in the fintech sector.

Daychopan emphasizes, “Plutus builds more than just a business; it creates a community of informed and empowered customers. Growth remains important, but staying true to our values is just as crucial.”

Plutus and the Future of Fintech

The fintech industry continues to evolve, and Plutus plays a meaningful role in shaping the financial rewards space. With a clear direction and a focus on user control, it has grown from a small startup into a key player in the fintech market. As the company moves forward, its commitment to customer autonomy and practical solutions will be essential for continued success.

The 2024 White Paper outlines Plutus’ plans to refine its offerings, including revised tokenomics and the introduction of Compounding Rewards Yield (CRY). These updates demonstrate the company’s ongoing efforts to provide value to its users.

Plutus remains well-prepared to navigate the challenges ahead and, with its focused vision and dedicated leadership, plays a significant role in the financial rewards sector. The future of financial rewards holds promise, and it is ready to contribute meaningfully to that future.