Pennies might have been one of the first official casualties in a monetary system that’s historically been defined by cold, hard cash, but they won’t be the last. The United States Treasury’s decision to stop producing pennies stemmed, in large part, from the cost of producing the penny (it costs four cents to produce each one-cent coin). But another part of that decision was the coin’s diminishing necessity in a society largely moving to digital payments — and inflation that makes rounding up feel more digestible than ever.

Similarly, physical bank branches — once concrete symbols of everyday financial life — are also on the endangered species list, as spending, saving, and moving money are easily handled digitally, without going anywhere. When it comes to Gen Z, a generation raised in a world of digital everything, most have never set foot in a bank branch to open an account or make a transaction.

All of this signals a profound transformation, one where the old cornerstones of finance are giving way to a new, digital-first era.

Yet, according to a new report from the Interledger Foundation (ILF)–an organization that’s making digital payments ubiquitous by modeling money’s movement on the way information moves across the Internet–Gen Z is surprisingly the most resistant of all generations to going totally cashless. They’re also the least knowledgeable about what distinguishes traditional banks from emerging challengers and payments apps.

In its report, A Cashless Country and the Future of Banks–Consumer Perspectives, ILF reveals what American consumers across generations think about going totally cashless and their varied understanding of what exactly makes a bank a bank.

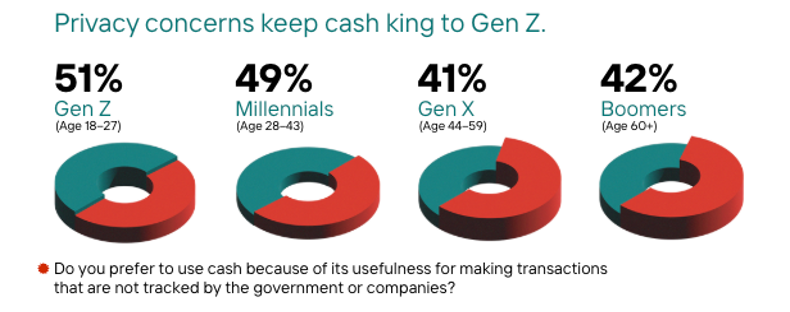

As recently as 10 years ago, the idea of a society that didn’t run on paper cash was unthinkable. But now, half of Americans (51%) say they’re open to it — and according to ILF, this number is expected to increase. Of those who want to keep cash around, Gen Zers were most likely to cite privacy concerns as their reason for not giving it up yet.

The report also revealed blurred lines on what makes a bank a bank. Fifty-six percent (56%) of Gen Z respondents weren’t aware that only traditional banks provide FDIC insurance–insuring up to $250,000 of their deposits–compared to 80% of Boomers. For emerging digital banks and prominent payments providers, what was previously a weakness (not being able to compete with FDIC banks’ relative safety) is decreasing in value to younger generations, who aren’t necessarily aware of traditional banks’ one remaining competitive advantage.

“Consumer’s willingness to move away from cash and the blurring lines between traditional banks and digital payments providers reveals the need for safe and affordable digital payments infrastructure across the US,” said Briana Marbury, President & CEO of the Interledger Foundation. “By paying attention to preferences, concerns and openness to change, it’s clear that there’s room in the market for open payments solutions that meet consumers’ evolving digital banking and payments needs.”

To Some Consumers, Payment Applications Are Nearly Synonymous With Banks

Since Gen Z grew up in a digital-first world, younger consumers view banking as a category of services that are not necessarily restricted to any particular institution. Only 56% of Gen Z consumers classify JPMorgan Chase as a bank, while 50% consider digital payments providers like Cash App a bank, despite its lack of direct FDIC insurance. When compared to the average across all generations, 64% of consumers categorize JPMorgan Chase as a bank, and 31% categorize Cash App and Chime as banks.

Gen Z Still Has Reservations About Going Cashless

Over half of Gen Zers (51%), Millennials (53%), and Gen Xers (51%) are open to a cashless life, but even the most digitally native among them cite privacy and fee concerns as reasons to keep cash around. This reveals that moving to a cashless society will need to address clear concerns on costs and safety while overcoming deeply embedded habits in people’s lives.

Old Habits Die Hard When It Comes to Cash Usage

Over half (56%) of respondents noted that they still pay with cash at least weekly. This reveals deep-rooted habits that digital alternatives must match, including in both cost and convenience, if organizations want to guide consumers towards a fully cashless society.

Location and Income Also Dictate Attitudes Towards Cash

Consumers’ willingness to move away from cash increases in more densely populated urban areas, where 58% of people say they’re open to going completely cashless. This is compared to only 40% in more rural areas. Willingness to move away from cash also increases with income, as only 42% of people who make less than $50k per year are willing, compared to 56% of those who make $150k or more per year.

Creating the Internet of Opportunity

Moving to a digitally dominant monetary system isn’t just good for the payments providers facilitating it — it has the potential to democratize financial access for individuals with limited access to or interest in traditional banks. The Interledger Foundation’s role in this is building the framework of a connected financial ecosystem that removes infrastructural barriers to free-flowing transactions between payment providers. It’s free, open-source technology grounded in the principles of openness, interoperability, and universality — enabling collaboration between mobile money systems, fintech platforms, and networks, regardless of their underlying technology or currency.

This work is foundational to a future where physical banks and cash are no longer necessary, making a cashless, inclusive society more achievable.