To explore the most influential trends in finance technology for small businesses, we asked founders and managing directors to share their insights. From embracing embedded finance to integrating AI-driven financial tools, here are the top seven predictions these experts provided based on their experience and industry knowledge.

- Embrace Embedded Finance

- Adopt Neobanks and Fintech Apps

- Utilize No-Code Financial Tools

- Leverage Observability in Financial Management

- Access Democratized Financial Tools

- Implement Green Fintech Solutions

- Integrate AI-Driven Financial Tools

Embrace Embedded Finance

I think that in the near future, the most influential trend in FinTech for small businesses will be embedded finance. This means integrating financial services directly into the non-financial platforms and ecosystems that small businesses already use to create seamless and more efficient financial operations. I believe the most notable benefit of embedded finance is that it will allow small businesses to offer integrated payment options within their platforms. This will enhance customer experience by providing a seamless and secure way to complete transactions.

Embedded finance will also enable small businesses to directly access insurance products tailored to their specific needs through their existing platforms. This will simplify finding and managing insurance, ensuring that businesses are adequately protected without the need for extensive research or separate applications.

Another notable benefit, as I see it, is that small businesses will have easier access to financing through embedded lending solutions. These services will be integrated into platforms that small businesses already use, such as an online payment platform or accounting software, allowing for quick and convenient loan approvals based on real-time financial data. This removes the hassle of applying for loans in traditional lending institutions and waiting for approval.

If I were to make a prediction, I’d say that by 2028, we will witness the majority of banks and credit unions utilizing embedded finance to offer credit and create demand while the nation benefits from the innovations created by the increased number of startups and other small businesses.

Bob Schulte

Bob Schulte

Founder, Bryt Software LLC

Adopt Neobanks and Fintech Apps

One of the most influential trends in finance technology for small businesses I’m seeing is the rise of neobanks and fintech apps. These digital banking solutions offer convenient, cost-effective, and user-friendly services, such as instant invoicing, expense tracking, and integrated payment solutions. The shift towards digital banking is accelerating, with more small businesses opting for neobanks due to their tailored financial services and superior user experiences.

These platforms often provide advanced features and seamless integrations with other financial tools, enabling small businesses to streamline their financial operations and improve cash-flow management. As a result, neobanks are becoming a preferred choice for small businesses seeking efficiency and flexibility in their banking needs.

Sergiy Fitsak

Sergiy Fitsak

Managing Director, Fintech Expert, Softjourn

Utilize No-Code Financial Tools

One of the most influential trends in finance technology for small businesses will be the widespread adoption of no-code tools. This revolution will enable business owners and their teams to develop bespoke financial solutions without the need for extensive programming knowledge. These platforms empower users to create anything from budgeting dashboards to automated invoicing systems, all through intuitive interfaces and simple drag-and-drop functionalities.

The beauty of no-code tools is their ability to democratize access to advanced financial analytics and automation previously reserved for tech-savvy individuals or larger companies with dedicated IT teams. Imagine a small business owner who can now automate their cash-flow forecasting or integrate diverse financial data sources into a single cohesive view—all without any help from a developer. This trend will not only streamline operations but also drive smarter, data-driven decisions, greatly leveling the playing field for smaller enterprises.

Mary Tung

Mary Tung

Founder & CEO, Lido

Leverage Observability in Financial Management

In the near future, I believe one of the most influential fintech trends for small businesses will be the rise of holistic financial-management platforms powered by observability. Here’s why:

- Data Overload and Siloed Systems: Currently, small businesses juggle multiple financial tools—accounting software, banking apps, payment processors—creating a fragmented data landscape.

- Observability to the Rescue: Observability tools will integrate seamlessly with these existing systems, collecting real-time data on cash flow, spending patterns, and overall financial health.

- Actionable Insights and Predictions: Using AI and machine learning, these platforms will analyze the data to provide actionable insights and predictive analytics. Imagine a platform that automatically identifies cost-saving opportunities, predicts potential cash flow issues, or suggests personalized financing options.

- Improved Decision-Making: This level of observability empowers small businesses to make data-driven financial decisions, optimize resource allocation, and proactively manage their cash flow.

This shift towards holistic financial management will be driven by several factors:

- Cloud-Based Solutions: Affordable and scalable cloud-based platforms make it easier for small businesses to access advanced financial tools.

- Increased Competition: Fintech startups are constantly innovating, offering user-friendly and integrated solutions tailored to small business needs.

- Democratization of Data: As data becomes more accessible and interpretable, small businesses can leverage it for better financial decision-making.

By embracing observability-powered financial-management platforms, small businesses will gain a comprehensive view of their financial health, unlock new levels of efficiency, and ultimately achieve greater financial stability and growth.

Ashwini Dave

Ashwini Dave

Product Marketer, Middleware

Access Democratized Financial Tools

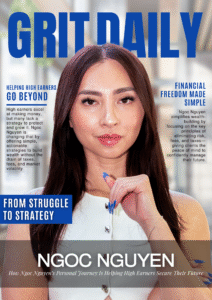

As a Personal Finance Consultant with years of experience in the financial technology industry, I have been in the financial technology sector for a while, and I can say that I consider the most effectively disruptive trend in financial technology for small businesses to be the democratization of using highly effective monetary tools.

We already see it in action with the onset of AI-driven accounting software, blockchain-powered lending platforms, and data-driven cash-flow management tools. These technological advancements were, up until now, afforded only by big corporations. The technologies are accessible to small businesses with affordable means and have leveled the playing field for success. This will only continue, as the small companies will be in a more startup-enabled position to make wiser, faster, and better-informed financial decisions.

Chris Yang

Chris Yang

Co-Founder & CEO, Coins Value

Implement Green Fintech Solutions

I am seeing the most influential trend of green fintech. It means technology is being used to promote sustainable and environmentally-friendly practices in the financial sector. This trend is gaining momentum as more and more small businesses are recognizing the importance of sustainable and environmentally-friendly practices. In fact, according to a recent survey by Bizzabo, 82% of consumers have a more positive image of companies that implement eco-friendly practices.

Consumers increasingly demand tools to track their carbon footprint. Tink’s findings reveal that 40% of UK individuals want banks to provide environmental monitoring resources, but only 24% of financial institutions offer them. Green fintech encompasses various initiatives such as the digitalization of paper-based processes, the use of renewable energy sources, the development of green investment products, and the implementation of blockchain technology for transparent tracking of funds.

These advancements benefit the environment and have a positive impact on the bottom line of small businesses. I believe that green fintech will continue to gain traction in the near future, driven by consumer demand and government regulations. The World Benchmarking Alliance projects sustainable investment fintech platforms will onboard 200 million new users globally by 2024. According to Global Market Estimates, the global green fintech market is expected to expand at a CAGR of 22.4% from 2024 to 2029.

Michael Benoit

Michael Benoit

Founder, ContractorBond

Integrate AI-Driven Financial Tools

I think that one of the most influential trends in finance technology for small businesses in the near future will be the integration of AI-driven financial management tools. Accounting software in general has made financial management seamless, but AI software will easily be able to automate tasks such as bookkeeping, expense tracking, and invoicing—which anyone in finance will be able to tell you will decrease manual effort and errors.

I also think that it might be a good jump into predictive analytics for cash-flow forecasting and financial planning. For small businesses that might not have the most in terms of resourcing, it’ll help them make more informed decisions and stay ahead of potential financial challenges.

All in all, I think that we are definitely going to see some pretty big changes coming for AI in finance.

Mark Wilkinson

Mark Wilkinson

Co-Founder and Financial Operator, TileCloud