Saving for retirement is crucial. No one can work forever, but traditional savings options might feel too limited for people with broad financial interests. If you’re interested in alternative options to standard IRAs, compare some of the best self-directed IRAs available to individual investors. You’ll put money aside for retirement with more flexibility that may better suit you if you’re interested in a more expansive array of assets.

What Are Self-Directed IRAs?

Self-directed IRAs are a type of individual retirement account (IRA) that includes investment options not available for people with Roth or traditional IRAs. They’re available through financial agencies specializing in this type of retirement savings because the investments work differently.

Although many people might not have heard about self-directed IRAs, research shows that 45% of American adults feel moderately to very comfortable managing their own retirement investments. Anyone with knowledge of investment strategies in numerous market types or entrepreneurs may consider self-directed IRAs more closely when determining the best way to prepare themselves for retirement.

Why IRAs Are so Important

Having multiple IRA options is vital because everyone approaches their financial situation differently. Some people want an investor handling their savings, while others look into the best self-directed IRA companies to feel more in control of their money over time. You might feel the same way, depending on how confident you are investing in alternative assets such as:

- Precious metals

- Real estate

- Private placement securities

- Cryptocurrency

- Tax lien certificates

- Promissory notes

As with any financial savings depending on investments, there’s always some risk to opening an IRA. Self-directed investments put money into more risky assets that may not have as much federal oversight as stocks or bonds. The assets might also fluctuate with unpredictable public events, like cryptocurrency. A self-directed IRA could be the better, more independent retirement option if you understand those risks and know how to watch for or plan around them.

Self-Directed IRA Withdrawals, Contributions and Taxes

Traditional IRAs have contribution and withdrawal caps, plus specific taxes to encourage people to keep their money in their investment accounts longer. Self-directed IRAs work similarly. The latest Internal Revenue Service (IRS) update limits annual contributions to $7,000 per person and imposes a 10% financial penalty for withdrawing before you’re 59 and a half years old.

The IRS may also charge a 10%-25% additional tax if you withdraw money two years after opening your IRA or before turning 59 and a half. Anyone who opens a self-directed IRA or traditional account must prepare themselves to keep their money in those investments long term to avoid these fees.

Best Self-Directed IRA Companies

These companies offer some of the best self-directed IRAs. They’re the most popular options for independently minded investors because they provide different benefits and membership plans.

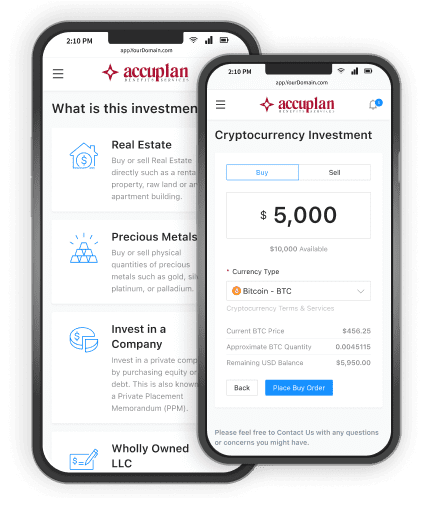

1. Accuplan

The experts behind Accuplan have been helping people with self-directed IRAs since 2007, including entrepreneurs seeking this type of retirement option for their businesses. Clients can manage their investments through Accuplan’s dashboard and consult the company’s team for assistance when needed. While putting your money in your preferred assets, the Accuplan team ensures your account meets all IRS compliance rules.

| Accuplan Self-Directed IRA Benefits |

| Direct contributions, rollovers and transfers are welcome. |

| The client dashboard allows individual monitoring and updates without a phone call or meeting. |

| A team of experts will monitor your investments to ensure they comply with state and federal laws. |

| Investment opportunities include private equity, real estate, cryptocurrencies, precious metals, private placements and private debt |

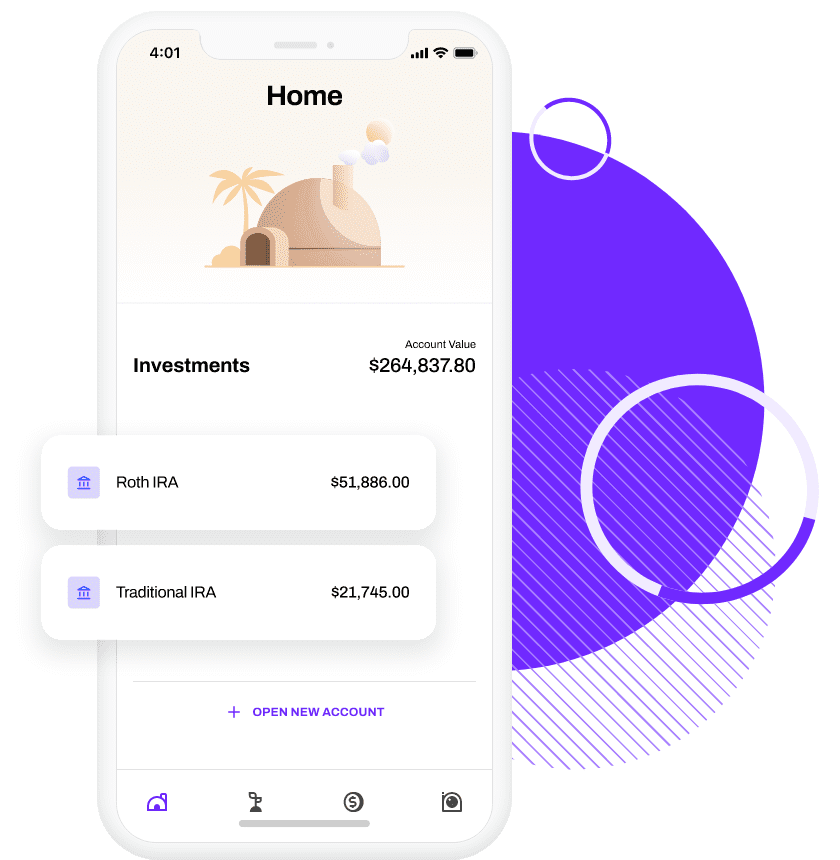

2. Equity Trust

Equity Trust is another company that provides self-directed IRAs to individuals or people interested in business accounts. Clients of this company get access to counselors for investment questions and options that include mutual funds, stocks and bonds. If you’re not sure what you want, the team can help you establish your IRA before providing unlimited time to explore their Investment District online marketplace.

| Equity Trust Self-Directed IRA Benefits |

| A minimum starting contribution of $500 — rollovers and transfers are welcome. |

| The client dashboard allows for individual monitoring and instant team contact. |

| The client dashboard connects your investments with over 400 Equity Trust associates. |

| Investment opportunities include private equity, real estate, cryptocurrencies, precious metals, private placements, private debt and more |

3. Rocket Dollar

Rocket Dollar provides some of the best self-directed IRA and traditional IRA accounts. Anyone with a Rocket Dollar Self-Directed IRA gets access to over 70 partner companies specializing in specific types of investments. Whether you want to put your money in cryptocurrency, startups, renewable energy or more, Rocket Dollar can connect you with people who know how to make that happen. Webinars, blog posts and podcast episodes are also available to anyone interested in ongoing learning regarding their investments.

| Rocket Dollar Self-Directed IRA Benefits |

| Starting contributions, rollovers and transfers are welcome. |

| The client dashboard allows for individual monitoring and instant team contact. |

| Ongoing learning resources are available for clients. |

| Investment opportunities include anything conducted by Rocket Dollar’s 70+ investment partner companies. |

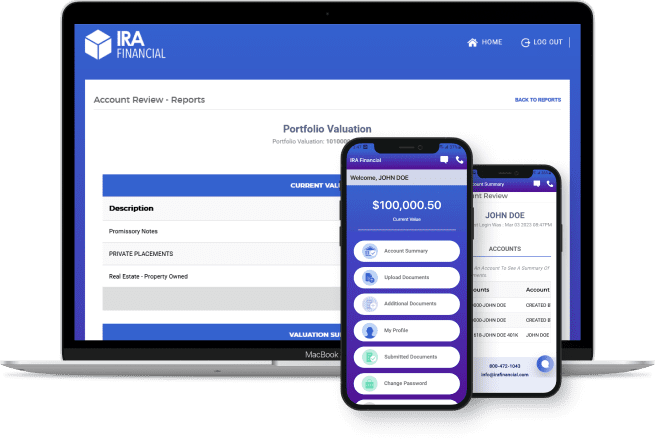

4. IRA Financial Group

Many people choose the IRA Financial Group because the company has in-house tax and Employee Retirement Income Security Act (ERISA) experts ready to assist with client investments. Individuals can contribute through the IRA Financial app and learn more about investing through the company’s available books. You’ll have IRS audit protection while learning how to improve your investment skills with numerous asset options.

| IRA Financial Group’s Self-Directed IRA Benefits |

| Starting contributions, rollovers and transfers are welcome. |

| The client dashboard and app allow for individual monitoring and instant team contact. |

| Ongoing learning resources are available for clients. |

| Account opportunities include SEP, Roth, traditional, ESA, SIMPLE IRA or HSA |

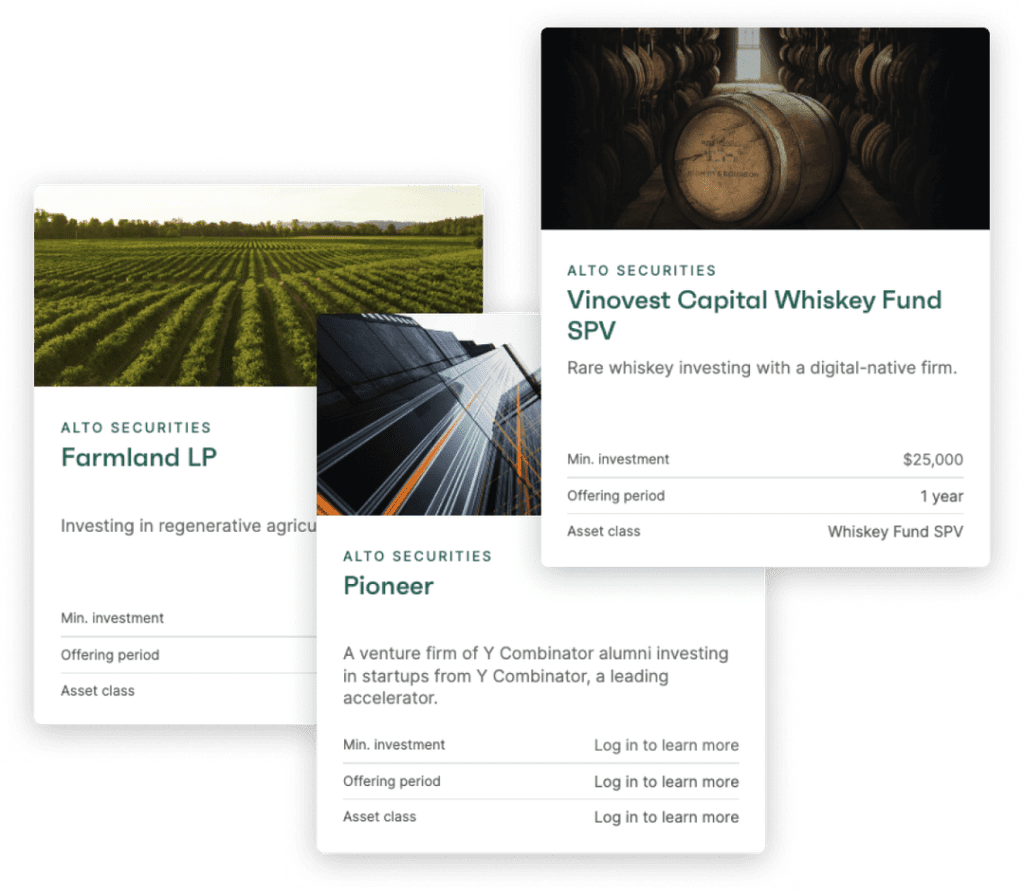

5. Alto

Alto’s team wants individuals to access the same broad range of investment assets typically only available to wealthy people with financial experience. Its private marketplace alternatives give clients access to curated investment opportunities from the Alto team. Membership fees depend on your total capital with the company, which might make it more affordable for people with limited current savings.

| Alto’s Self-Directed IRA Benefits |

| Starting contributions, rollovers and transfers are welcome. |

| The live investment marketplace consistently updates with new opportunities. |

| Twelve available partners open asset opportunities beyond traditional investment methods. |

| Account opportunities include SEP, Roth, traditional, self-directed or Alto CryptoIRA |

Compare the Best Self-Directed IRAs

Comparing the best self-directed IRAs will help you determine which companies to contact regarding your future savings. Studying their benefits and investment options will chart your next step toward a diversified retirement portfolio.