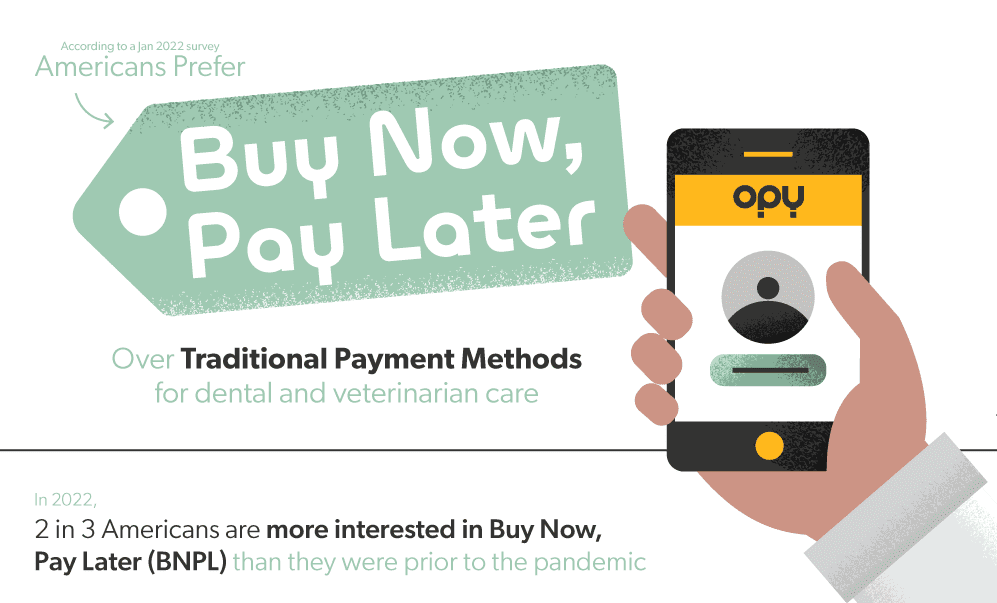

Buy now pay later (BNPL) is a form of payment that allows consumers to purchase the goods and services they need without the stress of credit card debt. With so many people in positions where they were out of a job or were just experiencing financial insecurity during the pandemic, BNPL provided a great alternative to traditional payment methods. Now that the pandemic is coming to an end, there are still so many people who are using this method due to the many benefits.

Uses for Buy Now Pay Later

BNPL has become increasingly popular with people who own pets who are looking for new ways to pay for vet bills. 77% of pet owners are familiar with BNPL and more than half of those have already used it as an alternative to credit, debit, or cash purchases. People who have already used BNPL appreciate the flexibility in payments and how you can avoid fees and interest that can accrue when using credit cards.

It’s no wonder so many pet owners use BNPL when vet bills can be so expensive. Only 32% of people are able to immediately pay off vet bills fully at the time of the visit. An even smaller percentage of people have insurance to help cover the costs which leads to almost half of pet parents needing to take at least a month to pay off their pet’s care. 86% of pet parents say that they would choose BNPL in place of traditional payment methods to help them pay for future vet costs.

BNPL and Medical Bills

BNPL can also be helpful when it comes to paying your own personal medical bills. Even trips to the dentist can wrack up a hefty bill these days, and many people need to rely on credit in order to cover the costs. There are lots of hidden fees that can come along with credit cards, neverminded the interest that accrued as you work to pay off the bill. By the time you’ve paid off your initial trip, you’re paying the credit card companies even more! BNPL has fixed rates so you can take the time you need to pay off your bills without worrying about any extra interest.

BNPL is gaining popularity all across the country, but millennials on the East Coast have been embracing this new way to pay more than other groups. Millennials’ interest in BNPL increased more than any other age group during the pandemic! This could be due to millennials mostly leaving college or joining the workforce during this time which made them more vulnerable to financial insecurity as a whole. BNPL allowed for millennials to continue buying goods and receiving services they need during this time without worrying about how they were going to pay in the long run.

In Conclusion

The majority of Americans are embracing this new way to cover costs for purchases both big and small. With flexible payment schedules, fixed rates, and no interest, BNPL offers a great alternative to traditional payment methods. While it may be strange to get used to right away, the benefits make it clear that BNPL is the new way to pay.

Source: Opy.com